Contribution Types – Concessional vs Non-Concessional

You will hear SMSFcentral and others talk about multiple types of contributions (Employer, Salary Sacrifice, Personal etc), but as far as the ATO is concerned, there are two designations that matter – Concessional and Non-Concessional.

Concessional contributions are any contributions which have to be taxed at 15% within the SMSF. These include Employer and Salary Sacrifice contributions, which are paid out of your pre-tax income by your employer, as well as Personal Concessional Contributions.

Personal Concessional contributions are payments made from your pocket (so from money which has already had income tax of around 35% – 45% charged on it). By completing a “Notice of Intent to Claim a Tax Deduction (S290) form”, you can have these amounts charged the 15% super tax within the SMSF and then claim the income tax you’ve already paid as a deduction on your personal tax return.

Non-Concessional contributions are payments made from your pocket, but with no claim for a tax deduction in your personal tax return being made. The Cap for Non-Concessional is much higher than the Concessional Cap, as explained below.

Who Is Eligible To Make Contributions into Super?

Employers can always make contributions into superannuation for their employees, regardless of the employee’s age, without any restrictions, but personal contributions have restrictions applied to them.

The main restriction is the Work Test, which applies to members who are aged 67 or over. Please read our article on Work Test Requirements here

Contribution Caps – How Much Can You Contribute Each Year?

Concessional Contribution Cap

The Concessional Contribution Cap is increasing to $27,500 from 1 July 2021.

The way the Concessional Contribution Cap works is relatively straightforward. As mentioned above, all Employer, Salary Sacrifice and Personal Concessional contributions are counted towards this cap.

Unused Concessional Contribution Carry Forward Allowance

From 1 July 2018, members who have not used the entire concessional contribution cap allowance will have their unused amount rolled over on a rolling 5 year basis.

As an example, let’s say Jarrod received employer contributions of $10,000 for the 2019, 2020 and 2021 financial years and hadn’t made any salary sacrifice or personal concessional contributions during those years.

During the 2022 financial year, Jarrod sells a property for a significant capital gain. His accountant recommends putting as much into the SMSF as Concessional as he can, so that he can claim a larger deduction to offset the gains.

Jarrod can now contribute the $45,000 in unused concessional contribution amounts for the past 3 years, as well as any remaining concessional cap amount for the 2022 financial year and claim a tax deduction for that amount in his personal tax return.

Non-Concessional Contribution Cap

The Non-Concessional Contribution Cap is increasing to $110,000 per year from 1 July 2021.

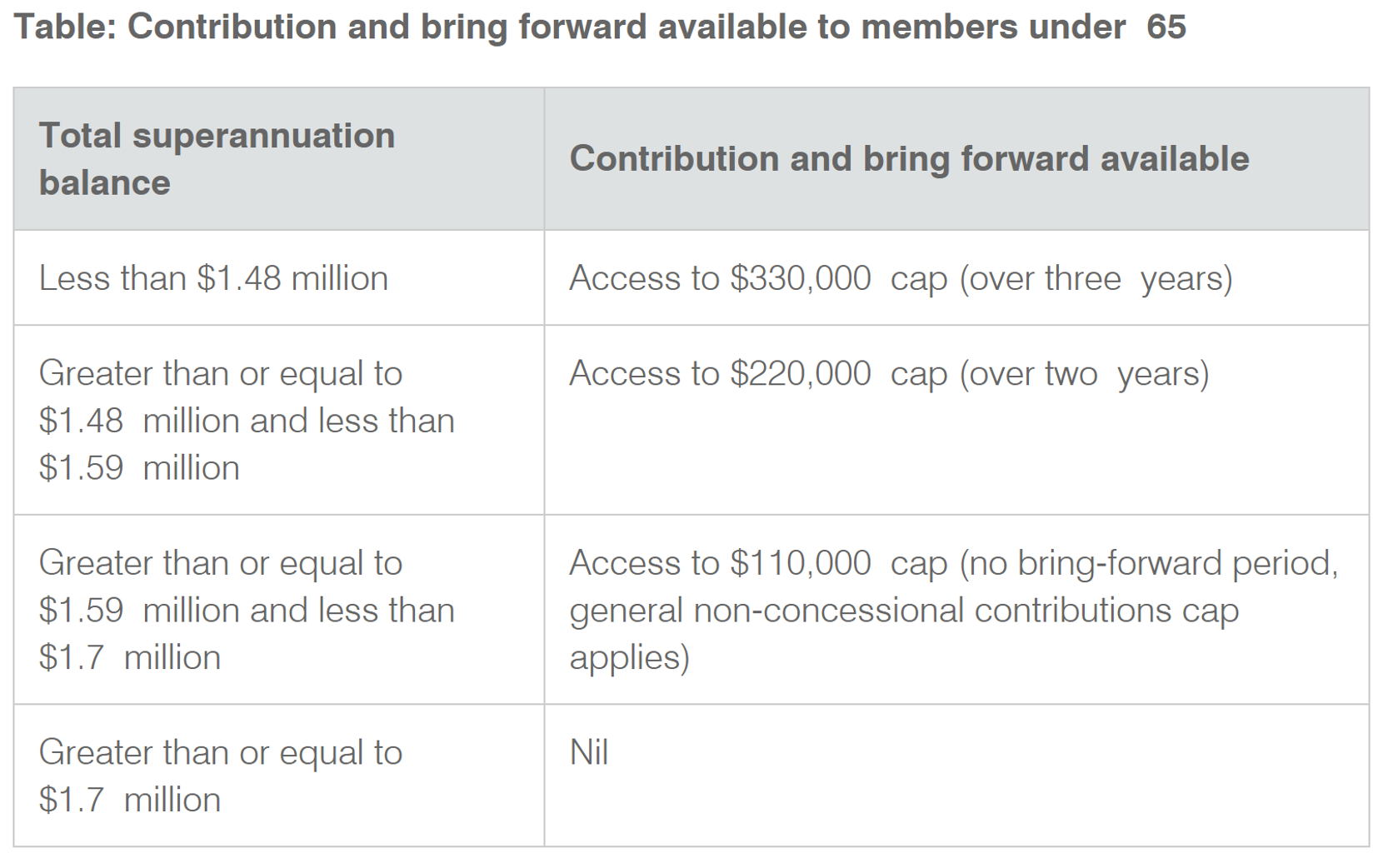

Members under the age of 65 may be able to use the Bring Forward Rule, which allows them to contribute up to 3 years’ worth of the annual non-concessional cap in a single year.

With the introduction of the Transfer Balance Cap for pensions and the Total Super Balance rules, use of the Bring Forward Rule is dependent upon a member’s Total Super Balance (the amalgamated balance of all money that person holds in all super accounts) as well as the contribution cap itself. The following table shows how much of the Bring Forward amount can be used, depending on the Total Super Balance of the contributing member:

For more information on contributing to super or if you have any other queries, please get in touch or call us on 1800 24 23 22.

GENERAL ADVICE DISCLAIMER – Any advice (perceived or otherwise) in this communication is of a general nature only. It does not take into account your objectives, financial situation or needs. Please seek personal advice before making a decision about a financial product or acting on any information in this communication.